Satuan Acara Perkuliahan (SAP) Manajemen Keuangan 1

SATUAN ACARA PERKULIAHAN

SEMESTER GENAP 2013/2014

ECM 201 ~ Manajemen Keuangan 1

Tgl | PokokBahasan | Sub PokokBahasan | Bab |

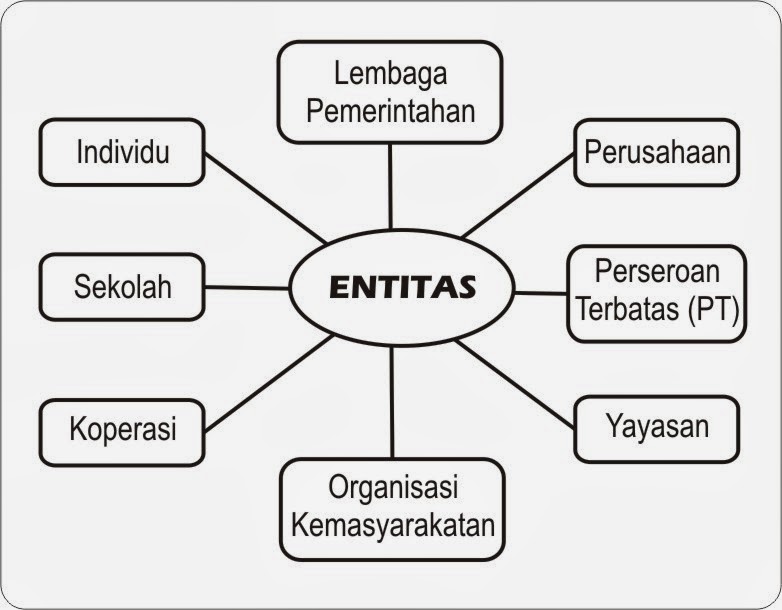

18/01 | Introduction to Corporate Finance | Corporate Finance and the Financial Manager The Goal of Financial Management The Agency Problem and Control of Corporation Financial Markets and the Corporation | Chp 1 |

25/01 | Financial Statements, Taxes and Cash Flow | The Balance Sheet The Income Statement Cash Flow | Chp 2 |

01/02 | Working with Financial Statements | Cash Flow and Financial Statements Standardized Financial Statements Ratio Analysis The Du Pont Identity | Chp 3 |

08/02, 15/02 | Long Term Financial Planning and Growth | What is Financial Planning Financial Planning Models The Percentage of Sales Approach External Financing and Growth Some Caveats Regarding Financial Planning Models | Chp 4 |

22/02 | Introduction to Valuation : The Time Value of Money | Future Value and Compounding Present Value and Discounting More about Present and Future Values | Chp 5 |

01/03 | Discounted Cash Flow Valuation | Future and Present Values of Multiple Cash Flows Valuing Level Cash Flows : Annuities and Perpetuities Comparing Rates : The Effect of Compounding Loan Types and Loan Amortization | Chp 6 |

Ujian Tengah Semester~ 06 SD 19 Maret | |||

22/03 | Interest Rates and Bond Valuation | Bonds and Bond Valuation More about Bond Features Bond Ratings Some Different Types of Bonds Inflation and Interest Rates | Chp 7 |

29/03 | Stock Valuation | Common & Preferred Stock Valuation Some Features of Common and Preferred Stocks | Chp 8 |

05/04 | Net Present Value and Other Investment Criteria | Net Present Value, The Payback Rule, The Discounted Payback, The Average Accounting Return, The Internal Rate of Return, The Profitability Index, The Modified Internal Rate of Return. | Chp 9 |

12/04 26/04 03/05 | Making Capital Investment Decisions | The Project Cash Flows Incremental Cash Flows Pro Forma Financial Statements and Project Cash Flows More about Project Cash Flow Alternative Definitions of Operating Cash Flows Some Special Cases of Discounted Cash Flow Analysis | Chp 10 |

03/05 10/05 | Project Analysis and Evaluation | Scenario and Other What-If Analyses Break Even Analysis Operating Cash Flow, Sales Volume, and Break Even Operating Leverage Capital Rationing | Chp 11 |

Ujian Akhir Semester~ 12 sd 26 Mei | |||

BukuWajib:

Fundamentals of Corporate Finance, Asia Global Edition, Ross, Westerfield, Jordan, Lim and Tan, Mc-Graw Hill

Penilaian :UTS 40%, UAS 40%, KK 20%

Ketentuan perkuliahan:

- Kuliah mulai pukul 07.00 WIB, toleransi keterlambatan sampai 07.15 WIB.

- Wajib membawa text book dan kalkulator

- Tidak ada quiz bagi yang tidak membawa text book dan kalkulator

- HP dinon-aktifkan dan mhs tetap berada dalam ruangan selama kuliah berlangsung

- Tidak ada tugas susulan maupun quiz susulan

- Tidak ada toleransi untuk % kehadiran (kecuali rawat inap)