Satuan Acara Perkuliahan Manajemen Keuangan I

SATUAN ACARA PERKULIAHAN

Matakuliah (Kode Matakuliah): Manajemen Keuangan I / ECM 201

Fakultas/Program studi : Ekonomi / Manajemen

SKS : 3 (tiga) SKS

Prasyarat : ECM 106 (C) ; ECM 215 (D)

I. Deskripsi Matakuliah

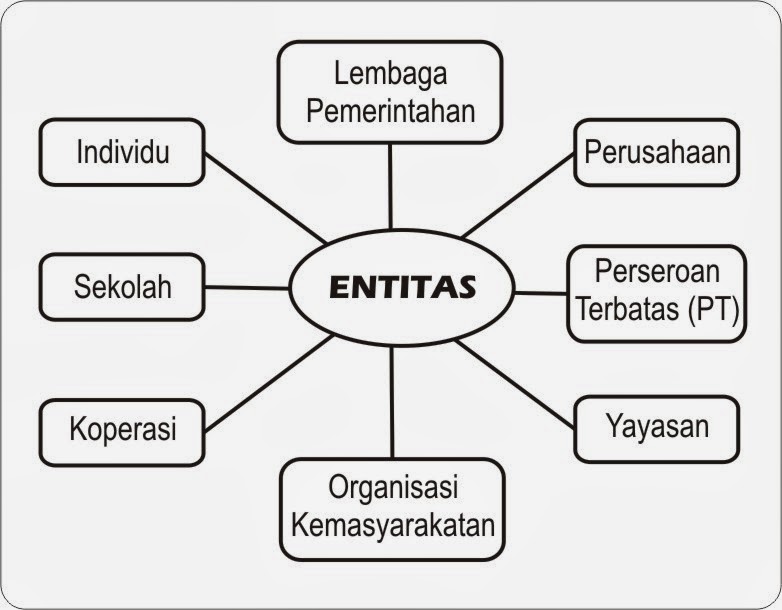

Matakuliah ini mempelajari konsep dasar bagi manajemen keuangan didalam pencapaian tujuan untuk memaksimalisasi nilai perusahaan.

II. Tujuan Instruksional

Memberikan pemahaman tentang : (a) tujuan dan tugas pokok manajemen keuangan serta masalah agensi dalam perusahaan, (b) membuat perencanaan keuangan secara sederhana, (c) melakukan analisis laporan keuangan

secara sederhana, (d) menghitung nilai waktu dari uang, (e) menghitung nilai layak obligasidan saham, (f) serta

melakukan analisis proyek secara sederhana (capital budgeting).

III. Pokok Bahasan

| Week | Tujuan Pembelajaran | Topik Pembahasan |

| 1 | Student should understand : · The basic types of financial management decisions and the role of the financial manager · The goal of financial management · The conflicts of interest that can arise between managers and owners | Chp 1 : Introduction To Corporate Finance · Corporate Finance and the Financial Manager · The Goal of Financial Management · The Agency Problem and Control of the Corporation · Financial Markets and the Corporation |

| 2 | Students should understand : · The difference between accounting value or book value and market value · The difference between accounting income and cash flow · How to determine a firm’s cash flow from its financial statements | Chp 2 : Financial Statements, Taxes, and Cash Flow · The Balance Sheet · The Income Statement · Cash Flow |

| 3 - 5 | Students should understand : · How to standardize financial statements for comparison purposes · How to compute and interpret some common ratios · The determinants of a firm’s profitability | Chp 3 : Working With Financial Statements · Cash Flow and Financial Statements : A Closer Look · Standardized Financial Statement · Ratio Analysis · The Du Pont Identity · Using Financial Statement Information |

| Students should understand : · How to apply the percentage of sales method · How to compute the external financing needed to fund a firm’s growth · Some of the problems in planning the growth | Chp 4 : Long Term Financial Planning and Growth · What is Financial Planning? · Financial Planning Models : A First Look · The Percentage of Sales Approach · External Financing and Growth · Some Caveats Regarding Financial Planning Models | |

| 6 | Students should understand : · How to determine the future value of an investment made today · How to determine the present value of cash to be received at a future date · How to find the return on an investment · How long it takes for an investment to reach a desired value | Chp 5 : Introduction To Valuation : The Time Value of Money · Future Value and Compounding · Present Value and Discounting · More about Present and Future Values |

| 7 | Students should understand : · How to determine future and present value of investment with multiple cash flows · How loan payments are calculated and how to find the interest rate on a loan · How loans are amortizes or paid off · How interest rates are quoted (and misquoted) | Chp 6 : Discounted Cash Flow Valuation · Future and Present Values of Multiple Cash Flows · Valuing Level Cash Flows : Annuities and Perpetuities · Comparing Rates : The Effect of Compounding · Loan Types and Loan Amortization |

| UJIAN TENGAH SEMESTER | ||

| 1 | Students should understand : · Important bond features and types of bonds · Bond values and yields and why they fluctuate · Bond ratings and what they mean · The impact of inflation on interest rates | Chp 7 : Interest Rates and Bond Valuation · Bonds and Bond Valuation · More about Bond Features · Bond Ratings · Some Different Types of Bonds · Inflation and Interest Rates |

| 2 | Students should understand : · How stock prices depend on future dividends and dividends growth · The different ways corporate directors are elected to office | Chp 8 : Stock Valuation · Common Stock Valuation · Some Features of Common and Preferred Stocks |

| 3 | Students should understand : · The reasons why the net present value creations is the best way to evaluate proposed investments · The payback rule and some of its shortcomings · The discounted payback rule and some of its shortcomings · Accounting rates of return and some problems with them · The internal rate of return criterion and its strength and weaknesses · The modified internal rate of return · The profitability index and its relation to net present value | Chp 9 : Net Present Value And Other Investment Criteria · Net Present Value · The Payback Rule · The Discounted Payback · The Average Accounting Return · The Internal Rate of Return and Modified Internal Rate of Return · The Profitability Index |

| 4 - 6 | Students should understand : · How to determine the relevant cash flows for a proposed project · How to determine if a project is acceptable · How to set a bid price for a project · How to evaluate the equivalent annual cost of a project | Chp 10 : Making Capital Investment Decisions · Project Cash Flow : A First Look · Incremental Cash Flow · Pro Forma Financial Statements and Project Cash Flows · More about Project Cash Flow · Alternative Definitions of Operating Cash Flow · Some Special Cases of Discounting Cash Flow Analysis |

| 7 | Students should understand : · How to perform and interpret a sentivity analysis for a proposed investment · How to perform and interpret a scenario analysis for a proposed investment · How to determine and interpret cash, accounting, and financial break even points · How the degree of operating leverage can affect the cash flows of a project · How capital rationing affects the ability of a company to accept projects | Chp 11 : Project Analysis and Evaluation · Scenario and Other What-If Analyses · Break Even Analysis · Operating Cash Flow, Sales Volume, and Break Even · Operating Leverage · Capital Rationing |

| UJIAN AKHIR SEMESTER | ||

| IV. | Kriteria Penilaian | |

| | Ujian Tengah Semester (UTS) | 40% |

| | Ujian Akhir Semester (UAS) | 40% |

| | Kuliah Kerja | 20% |

V. Rujukan

Buku Utama:

Fundamentals of Corporate Finance, Asia Global Edition, Ross, Westerfield, Jordan, Lim and Tan, Mc-Graw Hill

Buku Anjuran:

Corporate Finance Fundamentals, 9th edition. Ross, Westerfield, Jordan. Mc-Graw Hill International

Essentials of Financial Management, 2nd edition. Brigham, Houston, Chiang, Lee and Arifin. Cengage Learning.